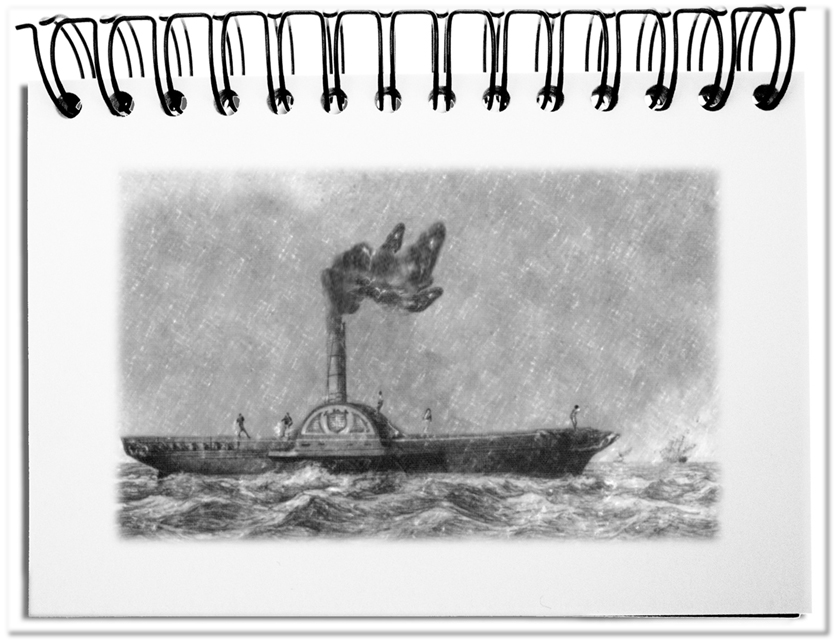

„We have to keep moving. Now heat the ship with the ship!“ On the first day the superstructure and the intermediate deck were burnt. On the second day, the masts, the rigging and sails were moved into the boiler. On the third day the railing and planks disappeared in the machine. Phileas Fogg renounced everything that was unnecessary in order to reach his destination, what he finally did – around the world in eighty days. When circumstances require, there is nothing left but to literally throw everything into the fire in order to accomplish the desired goal.

At the moment a global crisis is happening at an unprecedented speed. And the reaction is a panicky shock. Fortunately, the supply of food and other goods, fundamental infrastructures (water, electricity, waste disposal) and medical care are still running – especially through the personal engagement of the workforce. In Business the procedures, which are executed like a clockwork, are largely coming to a standstill – things are no longer produced, shipped, transported, delivered and installed as well as personal services can no longer be provided. Under completely new conditions, the still active business flows are operating and one day the stopped ones will also run again. What does this mean for the well prepared, closely knit business flows that are stuck in the IT corset? Which aspects must be considered?

- Not every step is necessary

Over the years, the processes were woven into a dense net – one after the other. And the machine thus created runs like a clockwork thanks to IT. With Corona this machine sputters or even stops. This is fatal for the interaction of the processes (see below). A restart of this kind might not be part of any risk plan. In order to restart business, you should

1) Adjust your expectations, i.e. do not expect everything to run as smoothly as before;

2) Undogmatically ramp up the areas step by step, i.e. do not fulfil all duties, but concentrate initially on those that are relevant to the results;

3) Coordinate with suppliers, employees and customers without stress, as all are all in the same boat;

4) Refrain from measures for the even further, the even higher and the even better during a certain period of time, i.e. do not maximize profits but minimize damages;

5) Adhere less to existing guidelines and instead allow more personal initiatives, since the many eyes of the employees see more than the few of the management. - Each handover point is latently necessary

Over the years, the interfaces between the processes, the divisions and the companies have converged in such a way that they run by themselves. Everyone knew what, when to do and what had to be delivered, by when, and in what quality. This worked well that, for example, one could rely on rolling storage bins within the framework of just-in-time. Now all the connecting factors have come to a standstill – raw materials and supplies cannot be delivered; components are no longer manufactured and sent on their way; products can no longer be assembled; customers no longer receive their products; and IT gets confused, because there is no constant flow of data. To get the whole thing up and running again, you should:

1) Check the quality of stuck deliveries, i.e. identify and separate goods that are no longer usable;

2) Operate the procurement and logistics processes more actively, i.e. coordinate and track deliveries more closely;

3) Ensure the completeness of deliveries to avoid congestions;

4) Above all, keep an eye on the IT interfaces, as the processes run in virtuality so fast that faster disasters could be generated. - The optimized interaction is jumbled up

The first two points already show that the interdependencies of the various business components are disturbed by this forced interruption. Even if the walls are still standing, the image of a ruin fits more likely. In this debris, no optimized sequences can take place for the moment, although all the components are still there. Power plants and IT data centers have recovery plans. But the certified business continuity may not cover the process world. For this reason you should now:

1) Remove disruptive debris, i.e. suspend inhibiting bureaucracy and unproductive steps;

2) Crisis managers should be deployed, who coordinate the most important internal and external functions for the time of the state of emergency;

3) Lost interfaces should be replaced by new ones, e.g. when suppliers go bankrupt and are no longer available due to the crisis;

4) IT interfaces should be checked and repaired, if necessary, or at least bypass with emergency solutions. - Responsibilities lack the overview

Before the crisis, the business provided an overview of incidents by means of a corresponding reporting system. An ingenious traffic light system showed those responsible an overview of the critical deviations. Now most traffic lights are red, and it is hard to decide where to look first. Even those, who have made up to now decisions without such reports, will be overwhelmed by the flood of problems. For this reason you should now take action:

1) Identify and monitor focal points of damage limitation so that the right decisions are made;

2) Bundle responsibilities to avoid a confusion of contradictory decisions;

3) Define clear decision paths for the time of the crisis, i.e. who is responsible for what;

4) Create emergency solutions, i.e. provide programs in an unbureaucratic manner that create transparency, if necessary on paper, so that blind flight is avoided. - The money is missing everywhere

The financial situation is difficult to master for small and medium-sized companies which do not employ financiers and lawyers – no income, still running costs, and due payments. Faced with insolvency, you are forced to do everything by yourself. For this reason you should:

1) Do not generate new costs, i.e. postpone new purchases and limit to those costs that promise short-term revenue;

2) Implement initiatives with on-board resources, i.e. use internal experts cross-functionally;

3) Exploit available, often free, opportunities, even if they do not meet the usual standard (e.g. free software on the Internet, even if it comes from unreliable regions such as the USA).

Such a crisis is unmanageable for globally interconnected economies. There are too many conflicting interests and, above all, stakeholders that want to take advantage of each other and hold themselves harmless by the society. And politicians have pushed themselves to the top to make decisions. When they turn out to be wrong, in the absence of their own expertise, the experts are to blame. There is no plan for such a far-reaching crisis that could reliably manage the whole thing. The solution lies with all those involved, who pull together in the same direction – employees, unions, managers, shareholders, lobbyists, politicians and, above all, the public. Merciless support is required. It is better to make a positive contribution of one’s own than to criticize the engagement of others. Our chance lies in using every initiative, no matter how big or small, to pull the car out of the ditch – together.

Bottom line, Phileas Fogg showed it to us. With a clear goal in mind, you can throw anything into the fire to accomplish the necessary. The task that still lies ahead is much greater than the most extensive proposals for improvement. Is the current situation as dramatic as described above? Maybe not (yet). Nevertheless, I hope that some people will be encouraged to think about their processes early on, in order to survive the crisis with as little damage as possible, especially now, when optimized processes have to function despite the crisis.