In August 1888 Bertha Benz made the first cross-country trip from Mannheim to Pforzheim with a fuel-driven car. At the first pit stop of history she got her gasoline (at that time Ligorin) at the city pharmacy of Wiesloch. 1909 the first Germany-wide listing of approx. 2500 gas stations (among other shops drugstores, grocers, and restaurants) was published. One hundred years later the number of German gas stations stabilized at almost 15,000 gas stations after more than twice as many gas stations in the 60s and 70s. With the electrical mobility the departure from the combustion-based individual traffic begins, although in modest steps. Surprisingly our political representatives only see the necessity of investing in bonuses and fiscal privileges with the purchase of electric cars, instead of taking care of creating the basic conditions for the required infrastructure. This distorted view of the E-mobility endangers the change to electrical traffic within the foreseeable future.

Currently approx. 44 million passenger cars (passenger car), 4 million motorcycles and 3 million trucks (TRUCK) are registered in Germany. There should be 1 million by 2020 and 6 million electric vehicles by 2030 on the road. However, this means that by then there are still over 80% of the vehicles with classical combustion engines. How to realize the conversion more quickly was shown by China. In the urban centers the classical gasoline-based two-stroke engines were forbidden. Until 2025 they have to disappear completely. Currently they already have 200 millions electro scooters running. In Germany the context of the electrical mobility is yet not sufficiently considered. The following examples show important core topics.

- Battery power

An important pre-requisite for the citizens is the range of the electric vehicles, although they drive only 40 km on average per day. The range is determined by the capacity of the battery. A consumption analysis with more than 240,000 vehicles uncovered in Denmark that the average consumption is about 183 Wh/km (46% more than indicated). Battery capacities reach from 60 to 90 kWh. This is enough for 150 to 450 km. Traffic jams are counter productive in this context, since the more slowly than 50 km/h vehicles drive, the more capacity is needed. The best efficiency was at an outside temperature of 14 degrees Celsius. - Charging infrastructure

The Alpha and Omega is the possibility to charge the battery. On average German drivers drive 80 minutes per day. That means that the car is parking for nearly 23 hours. Sufficient time for charging, if a suitable charging station is available. Private garages can be equipped quickly through personal initiatives. The 1.1 million parking lots in public areas (“On Street”) and the 2.6 million toll parking spaces in non-public areas (“Off Street”) need charging stations, in order to use any downtime. There are many arguments to reuse the existing supply places. Compared with today’s four gasoline pumps at a small gas station, in the future it takes at least 8 charging possibilities due to the duration of the charging procedure. It is a project of public interest to calculate the real costs to create a reasonable charging infrastructure. In any case the appropriate taps cost billions of Euros. - Charging interface

Obviously, we did not learn anything from the times of the format war of the video cassette systems. Instead of agreeing on an interface, different suppliers bet on the fact that their system prevails. And others are waiting to jump on the train of the survivor. Will it be the type-1-plug, the type-2-plug, the Combo plug, the CHAdeMO plug or the Tesla Supercharger? Or will there be further alternatives? Thus, all are facing a chaos of plugs that will have a negative impact on the acceptance. - Battery recycling

The heaviest issue for the electric car is the battery. With a weight of over 300 kg and a lifetime of 15 years the question arises, how the batteries will be disposed in the future. Hopefully the producers will take care, since this would ensure that they develop recyclable batteries. It would be good, if the politicians do not oversleep to take care of a final disposal like they did with the nuclear power. - New business models

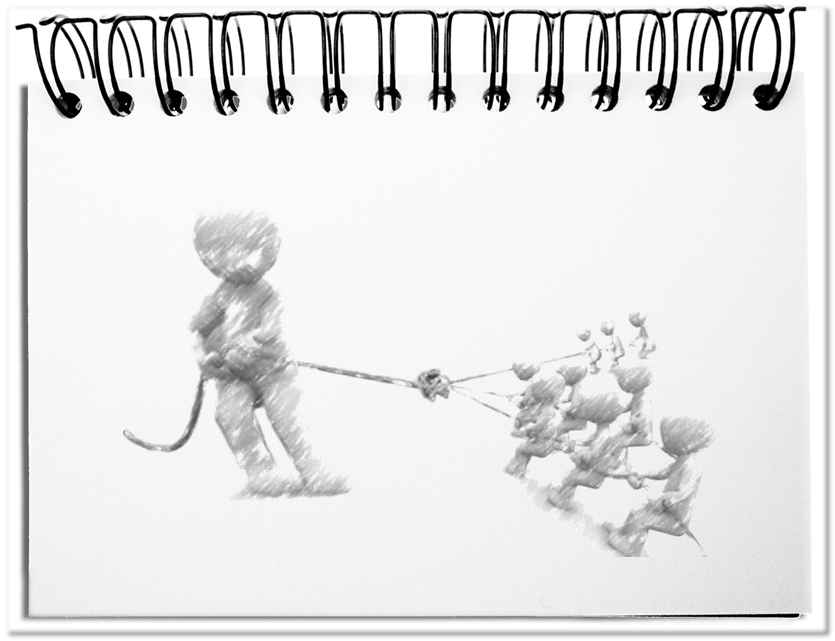

Not to forget the current business models of the gas stations. They are today located at traffic-wise ideal locations and operate with different business forms – from gas stations that belong to the oil companies, to franchise, to independent gas stations. Or is this even a completely new market segment for „The three from the charging station “? Will the existing models be extended or do the electricity companies push into the market? Considering the required connectivity to the electricity grid, basic measures are needed that the society must jointly take over, in order to realize a complete coverage all over Germany – and not fail as with the postal services, the telephone network or the train system.

Bottom line: With the distorted view of the electric cars and the subsidization of purchases the government proved that it does not yet understands the new system of the electric mobility. Without the above precautions for an E Mobility platform the past deployment of the tax funds did not foster this change. It would be important to support the manufacturers of good batteries, to ensure a ubiquitous charging infrastructure, the foster of a uniform charging interface, to ensure ecological recycling of the batteries as well as to support new business models for charge vendors. As soon as the responsible persons worry about the platform of the electric mobility, the distorted view of the E-mobility will disappear.