With digitalization, new storefronts are emerging that convey an image of the business that raises expectations that are not always met. Today, one has the chance to develop its showcase, the website, from a variety of prepared, seemingly elaborate layouts, in such a way that they no longer differ from mature companies. The whole thing is reinforced by customer references, which suggest that good relationships exist. However, it is not possible to see how strong and frequent and lasting services are provided. On closer look, the corresponding logos may even be used without permission – however, where there is no plaintiff… To what extent the company’s desire for exaggerated self-portrayal or mere overestimation of one’s capabilities is the intent, lies in the eye of the beholder. The moment of truth comes when cooperation takes place, and one has to realize that it does not fit soberly. If there is no comparable, inner reality, then we have a typical case of: All show and no substance.

How can you look in advance at the cards of potential partners? Glimpses are provided in the pages ‚Our company‚, ‚About us‚, ‚Our team‚, ‚Our network‚, ‚Products and Services‚, ‚Imprint‚ or ‚Contact‚. In the unlikely case that there are no references on the net, the company should be treated with caution. The following points reveal a rough picture of the company.

- The plural

Particular self-employed soloists, e.g., providers, who have no employees, often describe themselves in the plural with ‚we‚ or ‚ours‚. This self-image should be critically questioned. What is the purpose of the plural – concealment of the limited capacity, the indication of an invisible network, or only hubris. - The founding myth

Small and medium-sized companies are often built up out of nowhere by individuals. The history of the founding becomes the storyline of the website. The focal points of the narrative offer conclusions about the cooperation – top-down vs. bottom-up decision making, traditional vs. new values, preserving the old vs. creating something new. - The corporate facade

Enterprises have their websites created by agencies and offer few clues regarding leaders and employees. Here social networks provide a look behind the curtain. Even if especially the leaders are reserved, first impressions of the counterparts can be found – type, age, interests, hobbies, etc. - The lineup

If lists of employees are available, it is crucial to observe how often the individual employees are assigned to different areas. This repetition gives the public the illusion of a larger number of employees. A big number of employees suggests that they are doing good business. Additionally, it is seldom visible how long they have been working with the company, or whether they are still in training. Age is a good indicator of experience and time of employment. - The virtual team

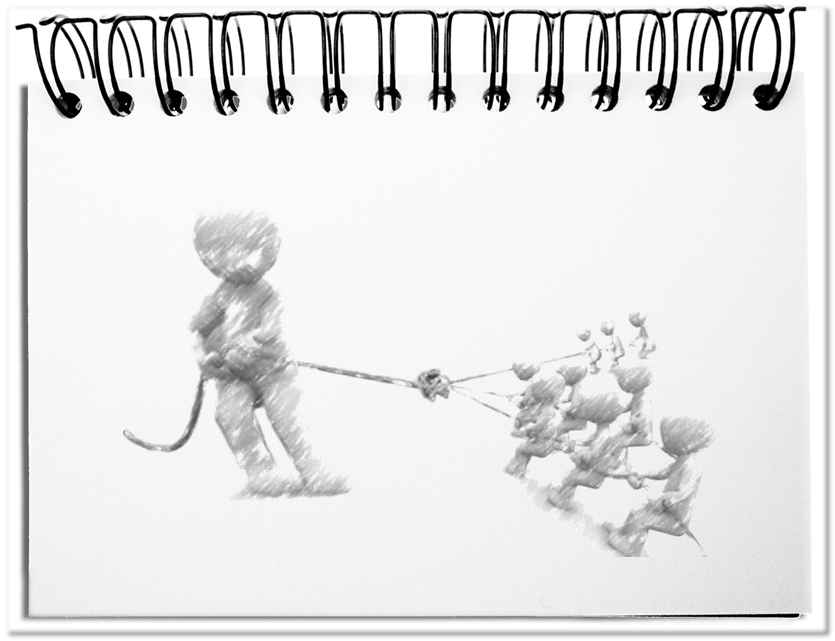

An easy way to simulate size and capabilities is to show business partners. For the self-employed soloist mentioned above, business partners are a backdoor to participate in larger tenders. Many purchasers are making their life easier by applying simple selection criteria – number of employees, references, and price. Self-employed singles fall through the cracks with the argument that they lack the capacities and do not have sufficient skills. And yet the jobs are so unique that the outcome is in any case delivered by individuals – whether they are part of a large company or working alone. The self-employed soloists provide significant advantages – low overhead, agility, and resulting low prices. - The cooperative

Partnerships are another pragmatic approach to stand up to larger companies. For this purpose, competitors temporarily bundle themselves into a cooperative that can fulfill orders jointly. This requires the partners to be willing to represent shared values, pursue similar priorities, and practice consensual action. However, it must be ensured that the contract comes first and not the individual interests of the partners. - The hubs

Corporate networks, platforms, or certifiers are entities in which firms can have one’s reputation certified for a corresponding price. An appropriate certificate conveys to the public that the relevant skills, values, and business practices exist, making the certified ones something special. The seals displayed on the website do not say anything about the companies‘ practices, but only for an annual fee and the time of the payment, those deliverables are confirmed – the extent to which independent tests by third parties would confirm this is a matter of faith. It is just the try to make quality standards for soft factors (e.g., leadership, motivation, appreciation, orderliness, etc.) measurable. - The deliverables

The offers are noteworthy, regardless of the size of the company. Are there overviews of the proposals with a link to more comprehensive descriptions? Do the individual actors of the deliverables become recognizable – or do the entrepreneurs put themselves in the center of attention? Do the deliverables provide information about the required efforts – orders of magnitude, calculation scheme, duration? Do the deliverables become comprehensible through additional information – whitepapers, blog posts, links to similar content? Above all, deliverables are difficult to assess since tangible criteria are missing. The duration and the amount of content generated do not reflect their effectiveness. Based on the descriptions, appropriate queries can be prepared. - The anonymous

If the imprint or contact does not provide any indication of the company’s registered office or if the related locations are not visible, then all efforts to establish a connection are superfluous, because the basis for reliable business is missing.

In summary, it is recommended to have a look at the website of a business partner. That way, you get a first impression of the company – beforehand. If the deliverables are convincing, you should contact the company. Depending on the size of the company, you will talk to experts immediately or, in the case of smaller companies, they will call back. If you are bombarded during the conversation with the usual phrases (e.g. ‚increase quality‚,‘ speed up processes‚, ‚reduce costs‚, or ‚stimulate growth‚), you should be careful. In the interest of a meaningful discussion, you should summarize the results at the end. For this reason, it is advisable to prepare questions in advance that ensure that the providers are talking about what you are interested in – and not their usual salmon.

Bottom line: Since the Glass Palace no longer makes the first impression of a firm, smaller companies and self-employed soloists can also present themselves impressively. The corresponding formats and contents are created at a low cost and displayed on the Internet. Regardless of the size of the company, it is advisable to take a closer look at these publications. Even if many believe that these contents are not read, all of them create a meaningful external presentation. A closer look at the company’s self-presentation and its deliverables make it possible to assess the company. An additional Google search, also concerning contact persons, completes the picture. In any case, you have the first impression of your contact persons and the company. Trust your gut feeling! If anything seems suspicious, look twice. There is always the danger: All show and no substance.