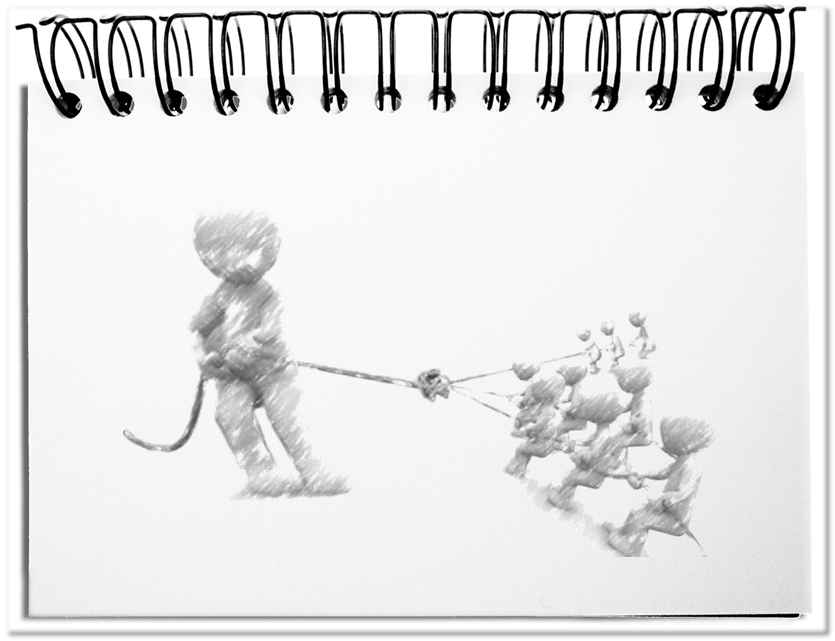

Henry Ford emphasized on mastering the entire value chain. He ran a rubber plantation to ensure the raw material for the tires. In northern Michigan he operated mines and shipped the iron with his own freighters in order to produce the required steel in his own smelting plant. This gave him 100% vertical integration. Today’s car manufacturers have reduced down to twenty percent. These companies have evolved into integrators, initially assembling their products on platforms and now out of modules. OEMs (Original Equipment Manufacturer) are still in the driving seat, but with suppliers of increasing size and influence, which are gaining more and more room to act. This will foreseeably turn the balance of power upside down and the OEMs will depend on the goodwill of their suppliers. By then, at the latest, SSSs will have evolved that will find out, what the suppliers value most, in order to continue delivering to the OEM.

This reversal of the relationship between manufacturer and supplier requires a new, or at least a different interpretation of the satisfaction criteria.

- Adequate performance

Ever since López de Arriortúa contaminated GM’s and later VW’s cooperation with suppliers, his legacy has continued to impact in the form of one-sided advantages of the OEMs. At the latest, when supplier satisfaction in terms of the ratio between expenses and earnings regains importance, the purchasing departments will return to old values – cooperation based on partnership, win-win, and mutual support. - Future prospects

The upfront services that are tailored for the customer, need good prospects for the vendor, otherwise the investment will be at the expense of the suppliers. The orientation of the deliverer towards the most promising companies ultimately forces the non-cooperative customers to take care of the external services themselves. The winners are the companies that perform their role as integrators to the satisfaction of both sides – e.g. by sharing and jointly developing long-term forecasts. - Smoothness

An important factor is easy cooperation. This is disturbed by exaggerated administration in the form of complex processes and lack of provision of required data. Every manufacturer has its own requirements, a huge army of contacts and compliance rules that prevent trusting cooperation. Frictionless and simple procedures would help both sides. - Relationship quality

It has been a long time since the Extended Company was proclaimed. Today, we are talking about platforms. The boundaries of the company no longer determine the relationships, but the respective task. For this reason, the employees must find ways to work in the steps of the process in harmony, trustingly and openly together with the partners – respectfully, promptly, and bindingly. - Image

In the past, it was important to be a purveyor to the court. This created a reputation that influenced all other businesses. The former „courts“, today’s corporations, have lost this reputation, because they squeeze out their suppliers to the last drop in favor of their own balance sheets. In order to survive in the future with module-based approaches, it is important to regain the former image so that it is something special to work together again.

Bottom line: SSS will place the cooperation between manufacturers and suppliers on new pillars. In the long term it must be worthwhile for suppliers to work again for certain companies. The avoidance of any kind of waste through formalisms will make the difference. In the end, cooperation does not take place between companies, but between people. And there the quality of the relationship must be moved again into the foreground, without pulling the Compliance card in each step. If the suppliers get some more of the manufacturer’s image, SSS will probably be so favorable that the future is secured for everyone.

P.S.: Those who cannot or do not want to think in this direction will sooner or later have to rebuild their modules themselves.