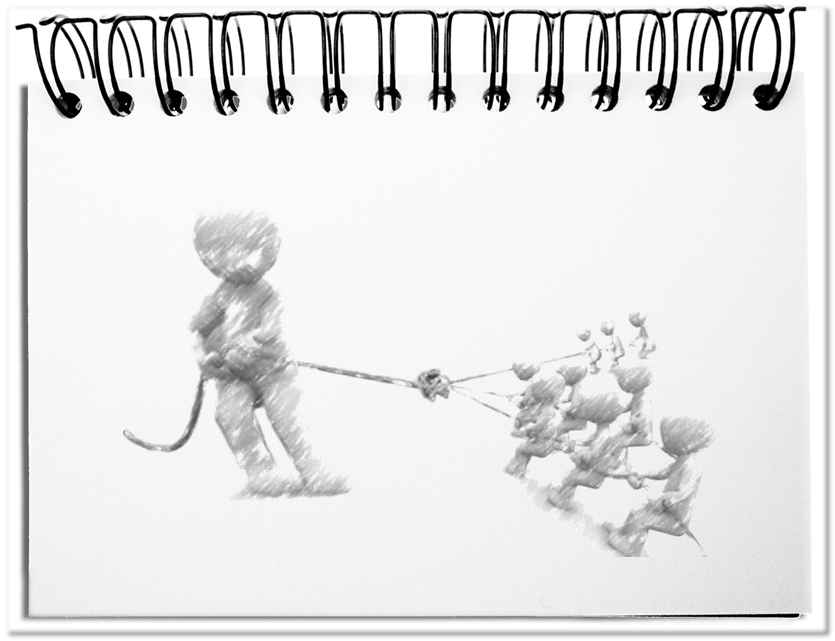

Henry Ford introduced that assembly-line. He was inspired by Taylorism and also made efforts, to get all levels of value creation under his control. For this purpose his enterprise had temporarily one hundred percent depth of production – plantations for rubber, glass factories, steel plants and power stations for the required energy. The automotive depth of production is on average approx. 20 percent. Thousands of suppliers share three quarters of the value of a car, from simple rotary switch to complicated injection or navigation systems.

Now, for the first time, this decrease of production depth has to be paid for. It took the small supplier’s years, but now they seem to be on eye level with those, who ruled the prices for years with their market power. At VW the production lines stopped, because obviously purchasing gambled away. Are we standing in front of a cooperative metamorphosis between manufacturers and suppliers?

After VW sound the bell for the last transformation, when they hired José Ignacio Lopéz and brought suppliers a new role, VW can not do other than delivering a reorientation concerning the interdependence between manufacturers and suppliers. The stop of Golf production in Wolfsburg that presumably creates for 20,000 employees short-time work is the wake-up call for the entire industry. The following mechanisms burdened the harmonious cooperation over the years.

- Adjustment of the supplier portfolio

After the internal improvement efforts and due to the low depth of production, there are not so many opportunities for reducing the expenses. All that remains is reducing the costs for the externally delegated 80 percent. In the absence of monetary incentives, the outside vendors could only be provided a benefit with the privilege of being part of the supplier circle. This means sometimes that they can participate to bid and to receive the traditional title purveyor to the court, as so-called strategic suppliers. - New pricing models

Only the enormous quantities offer a large lever that result in favorable conditions and prices. The huge numbers of items are the incentive for the suppliers. Simultaneously the timely and variant-oriented deliveries require further resources that additionally diminish the yield. - Exhausted terms of payment

The payments are not aligned to the need that the suppliers receive their money quickly, but they are based on the financial reporting dates. Consequently, the supplier carries the expenditure of the financing. This means that we talk about six months of prefinancing in the case of the procurement of material. However, there is no payment after delivery, but manufacturers wait, based on agreed payment targets for over three additional months to eventually pay their dues. The bridging of these time spans has to reproach the supplier – beside the raw materials, the wages and salaries, the storekeeping, the operation of the infrastructure etc. - New forms of negotiation

The personal negotiations in private that were the basis for trusting cooperation, are replaced by formal tender procedures and electronic forms of negotiation. The personal contact is removed from the businesses. This leads to quasi-automatic decisions based on good value for the money and general quality standards without personal impressions. - One-sided contract terminations

In many purchase departments still prevails the illusion to sit at the longer lever, since there are world-wide enormous amounts at suppliers, who seem to be ready to deliver at lower costs. This results quickly in the fact that a supplier, who falls in disgrace, will be eliminated in the blink of an eye. - Risk delegation to the suppliers

The upstream procurement of material and the stand-by resources increase the risk unilaterally to the disadvantage of the suppliers. If a contract expires or the manufacturer terminates a running contract, this can quickly lead to insolvency.

The possibilities to reduce the costs at the expense of the suppliers reached their limits. Also suppliers use outsourcing into country with low-wages. However, considering the narrow margins and the interdependence, new models for cooperation have to be found. The required exchange of information must take place mutually and count on Win-Win. In the future it will be essential that the buyers will be in personal contact with the suppliers, in order to get a local impression and to get in such a way to realistic estimates. The persistent compliance that was introduced particularly in the interest of the shareholders did not prevent abuse by particular people and harms cooperation.

Bottom line: Interaction between manufacturers and suppliers must be brought to a new level of confidence and joint benefit. The distribution of the value creation needs a reorientation in the economy and even for the politicians, who nowadays stand up for VW although they silently sat out the precarious situation of the suppliers for years. At the end of this phase the industry will be empowered, since the current inclination will be balanced out. This metamorphosis will again weld together manufacturers and suppliers, since the one cannot without the others.